As a beginner, you rely on stock brokers and investing companies to guide you in stock market investments. Gradually as you gain confidence and experience in stock marketing you become more aware of different levers that show performance. One of the important levers in share trading is technical analysis.

Technical analysis is the research of historical market data, including price and volume. Some technical analysis comprises of top 50 performing companies or top 100 profit making companies to give you detailed analysis of the sectors and different industries.

Technical analysis use insights from market psychology, predictive patterns, behavioural economics and quantitative analysis. Technical analysts consider past performance to forecast future market behaviour. The two most common forms of technical analysis are chart patterns and technical (statistical) indicators.

Technology has not only allowed investors to invest using online trading app, but has provided them with the tools needed to analyse stocks like the professionals. The analysis gained popularity more than ever over the last several years. Traders smartly evaluate historical fluctuations, past price movements to devise a forecast pattern for a security’s future price.

Fundamental analysis, the traditional and alternative method of stock evaluation, relies on a stock’s intrinsic value and requires a broader understanding of global ramifications, current affairs, political events and industry conditions and how companies are conventionally managed.

But how do investors look at the data, and what exactly are the advantages of technical analysis?

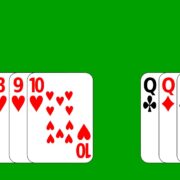

Many stock broking companies in India provide line charting, bar charting and candlestick charting as outputs of their technical analysis tool to help their traders. Candlestick charts is tried and tested charting format used for hundreds of years in Asian trading markets preferably for trading grains and crops.

Like a bar chart, the candlestick line show fluctuations bearing market’s open, high, low and close of a specific day. To make it understandable in a single glance, it uses colour and shading to show the range between the open and close of that day’s trading. For example, it is good to know latest IPO openings and closing for the day.

Both the charts are similar, however there is a big difference between the bar charts and the candlestick charts pertaining to opening and closing prices. Bar charts highlight the progression of today’s closing price from yesterday’s close. Candlestick charts show relationship between the closing price and the opening price of the same trading day.

Technical analysis is data driven. In most cases, technical analysis methods work from the psychological assumptions of the market. They are relative to that time period. One analysis done for that period cannot be used to analyse different period as the input data changes, depending on the consideration of the period. Candlestick patterns are reactions of the investors of that particular time. Stock market runs on herd mentality. The massive people reaction to the share market allows candlestick chart analysis to work in trading transactions.

You need to regularly check out latest developments in IPO market of India to invest smartly in stock market.